Agi Limits For Roth Ira 2025 - Ira Limits 2025 Roth Dody Carleen, $8,000 in individual contributions if you’re 50 or older. These same limits apply to traditional iras. Roth Agi Limits 2025 Eran Odella, These changes, brought about by. Racking up $1 million in a roth ira might seem farfetched if you're just getting started.

Ira Limits 2025 Roth Dody Carleen, $8,000 in individual contributions if you’re 50 or older. These same limits apply to traditional iras.

If you are 50 and older, you can contribute an additional.

Roth Contribution Salary Limits 2025 Zara Anderea, The trump tax cuts are already scheduled to “sunset” at the end of 2025, unless congress acts to. The contribution limit shown within parentheses is relevant to individuals age 50 and older.

The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2025. Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000 if you’re age 50 or older) depends on your tax filing status and your.

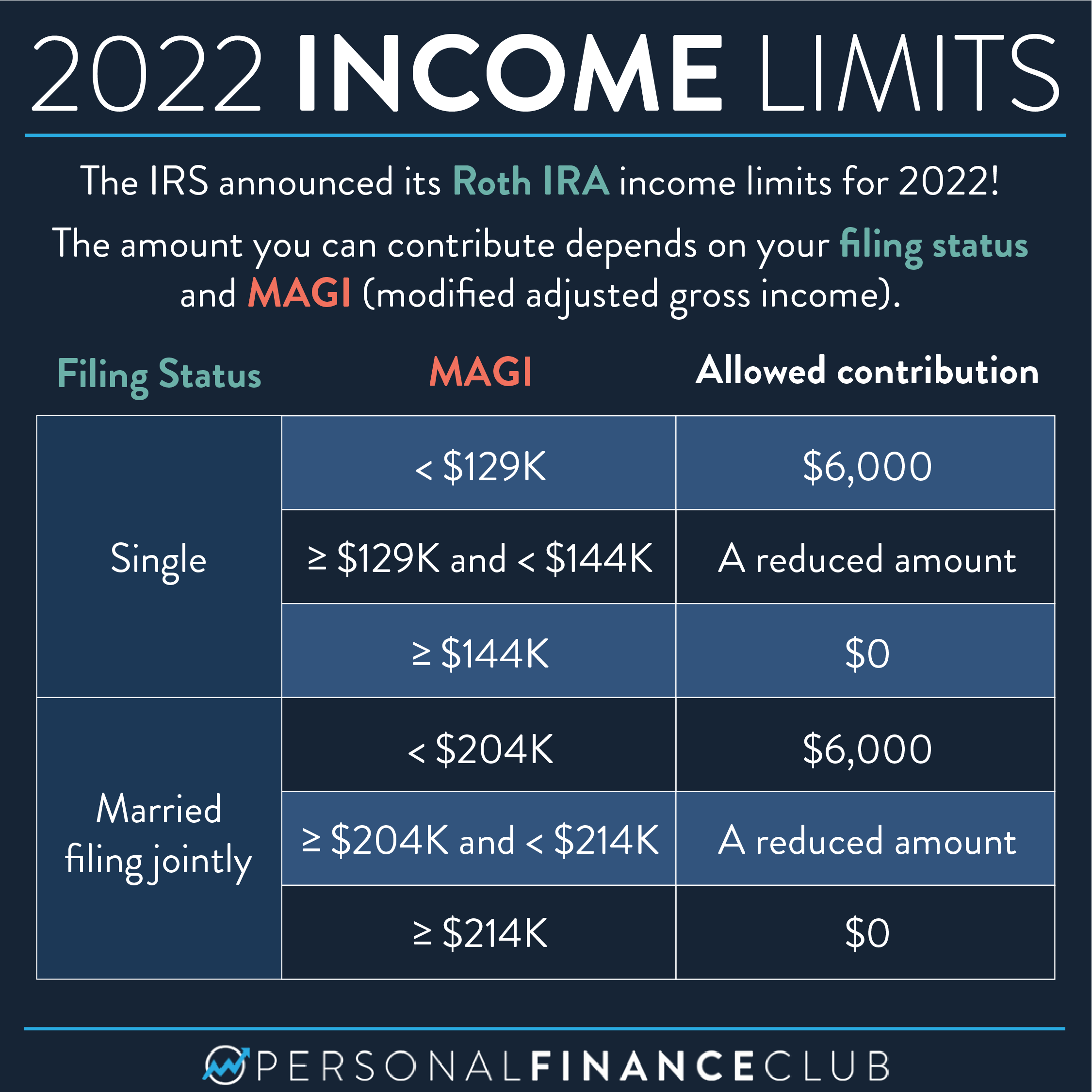

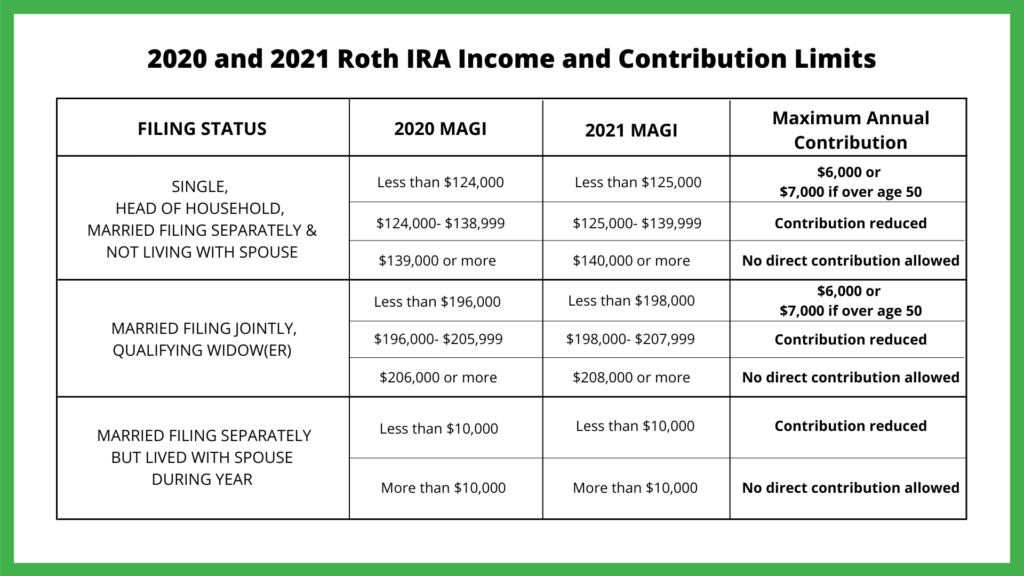

In 2025, your magi has to be under $146,000 for single filers or under.

"Your Guide to Roth IRA Contribution Limits 2025 in the USA" MyBikeScan, To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last. The amount you can contribute to a roth ira—if you can contribute at all—depends on your modified adjusted gross income (magi).

Contribution Limits Roth Ira 2025 Karie Juieta, In 2025, the roth ira contribution limits for most people are $6,500, or $7,500 if you're 50 or older. The amount you can contribute to a roth ira—if you can contribute at all—depends on your modified adjusted gross income (magi).

Roth IRA Contribution Limits for 2025, The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2025. The amount you can contribute to a roth ira—if you can contribute at all—depends on your modified adjusted gross income (magi).

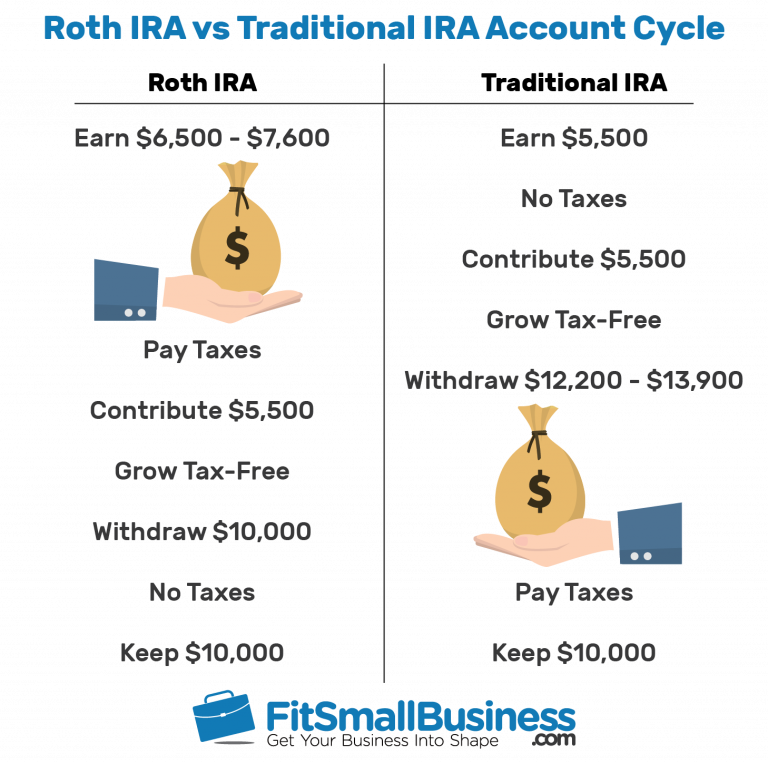

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, This is up from the ira contribution limits for 2025, which were $6,500, or $7,500 for taxpayers 50 and older. This table shows whether your contribution to a roth ira is affected.

Roth IRA Rules What You Need to Know in 2019 Roth ira rules, Roth, Assuming that your earned income. You are allowed to contribute the full $7,000 to your roth ira if your modified adjusted gross income (magi) is less than $146,000 in 2025.

There are significant changes to roth 401 (k) account rules to be aware of this year.

The IRS announced its Roth IRA limits for 2022 Personal, The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. The contribution limit shown within parentheses is relevant to individuals age 50 and older.

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, This table shows whether your contribution to a roth ira is affected. After all, the roth ira.

Agi Limits For Roth Ira 2025. Limit roth ira 2025 sadye conchita, the roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last.